EDITION

EDITION

THE MBAN & HLB MONTHLY PITCHING SESSION IS BACK

NOW KNOWN AS ENTER THE TIGERS’ LAIR, THE MONTHLY SERIES PROMISES A FRESH NEW APPROACH TO YOUR REGULAR PTCHING SESSION

SIX (6) STARTUPS BATTLE EACH MONTH TO SECURE FUNDING FROM

ANGEL INVESTORS AND COMPETE TO BE IN THE RUNNING

TO WIN A SPOT AT OUR QUARTERLY “ANGELS & UNICORNS”

PRIVATE DINNER WITH HIGH PROFILE ANGEL INVESTORS.

Do you have what it takes to

“Enter The Tigers’ Lair”?

If you are interested to pitch to Angel

Investors submit your application now!

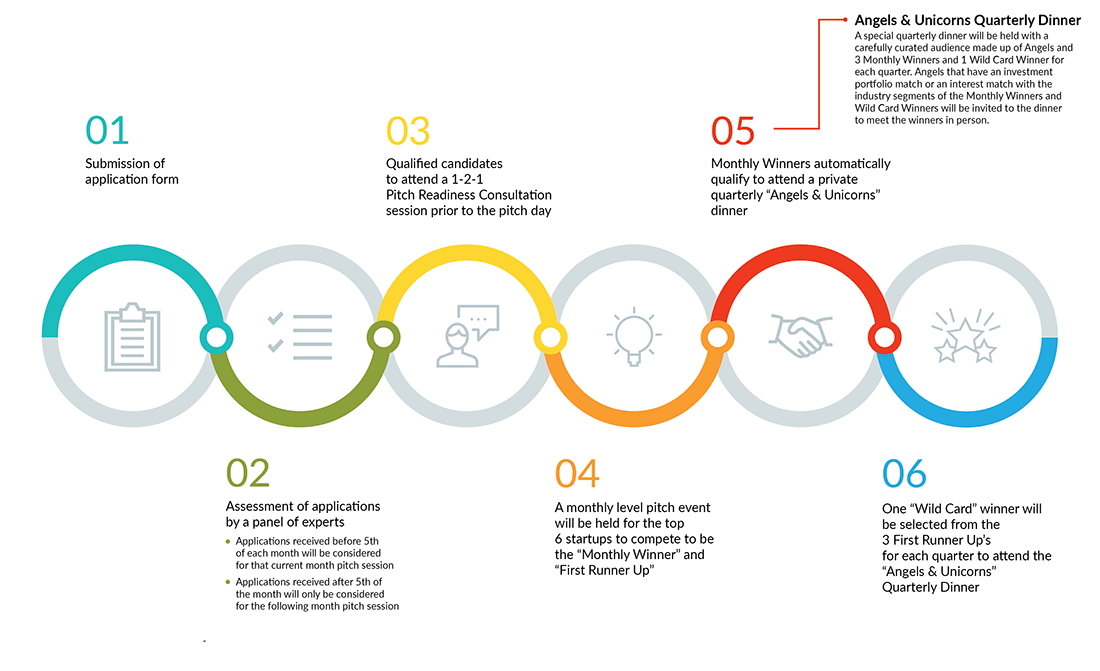

One of MBAN’s efforts is to continuously source for deals and showcase them in a monthly pitch event which is exclusive to our existing and potential members of MBAN. Now known as Enter The Tigers’ Lair, the monthly pitching series promises a fresh new approach to your regular pitching sessions. 6 Startups carefully selected from a pool of applications will battle to secure funding and interest from Angel Investors and secure a seat at the dinner table with Angels in the exclusive “Angels & Unicorns” Dinner.

This is a special quarterly dinner which is held after carefully curating the guest list that is made of Angel Investors/ High Networth Individuals and the Enter the Tigers’ Lair Winners (3) and Wild Card Winner (1)

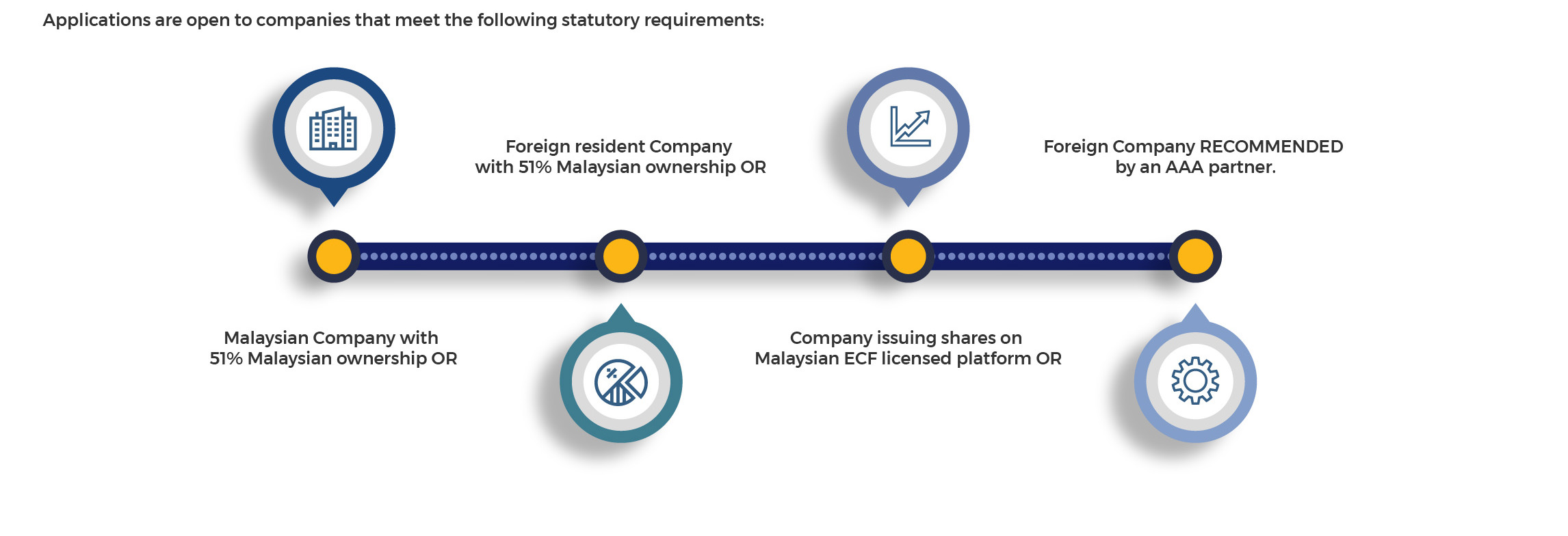

Applications are open to companies that meet the following statutory requirements:

Malaysian Company with 51% Malaysian ownership OR

Foreign resident Company with 51% Malaysian ownership OR

Company issuing shares on Malaysian ECF licensed platform OR

Foreign Company RECOMMENDED by an AAA partner.

Entries that do not meet the above conditions will be disqualified by MBAN. MBAN also reserves the right to disqualify any entry at any stage of the competition.

The evaluation of the startups/submissions registered for Enter The Tigers’ Lair at both stages are conducted by a panel of local experts curated and managed by MBAN. Evaluation will be based on the following criteria:

DISCLAIMER:

MBAN at its sole discretion may choose not to disclose certain information in a response to any question or query, if in our view such details would affect the fairness or transparency of the competition or convey an undue advantage to an applicant. MBAN also reserves the right to disclose to all other applicants an answer or clarification to a question from an applicant in the interest of fairness, objectivity, and transparency of this competition.

Interested in pitching at the next Enter the Tigers’ Lair?

CHECK OUT OUR CALENDAR FOR THE NEXT PITCH DATE!What is the problem you’re solving?

How are the current products in the market failing to address this problem?

Describe your product that you’ve developed (or will develop). What are the features? Focus on how your solution solves the problem/pain. Relate your product back to the pain that you’re trying to solve. Have you tested the solution? Have a short demo if possible (or screenshots).

Who pays? If you do not make money from your product, do the advertisers pay for ads? What are the ways to generate revenue? What are your costs? Would it be profitable based on your assumptions? What about your distribution channels and marketing plans? How will you build traction? How did you get the traction you already have (if you’ve pivoted, mention how is it different and working now).

Who are your potential customers (think of those having the problem). If possible, define them into segments. How big is this market? Is it growing? Would they adopt this solution? Would they spend/pay for your product or services? How much would they normally spend, if any?

Every product or service has competition. What is the alternative solution? Why would your potential customers choose your solution? How are you unique? What is the market fit i.e. how do you fit in the current landscape? What is your value, your USP (unique selling proposition)? Clearly state how are you different in your industry landscape.

Talk about your relevant skills. How did you get to where you are? If there are gaps, identify them and acknowledge that you will need to hire new talents to fill the gap.

What is next? What are your plans, goals and when do you plan to achieve them. If you already have achieved certain milestones, mention them (to include traction).

State your financial projections. How much do you need and why? To download a guideline for your pitch deck, please click here.