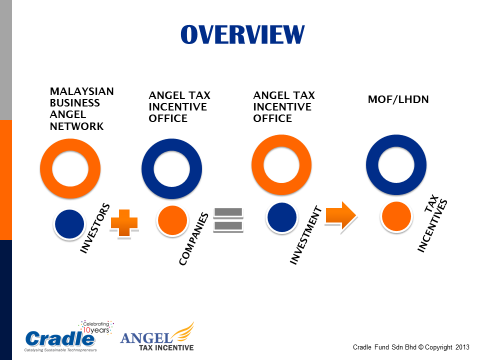

Malaysian Business Angel Network or better known as MBAN is a body that functions like a trade organisation, driving regional and international linkages between angel investors. MBAN is responsible for the accreditation of individual angel investors and angel investor clubs, creating awareness and training for investors, and monitoring angel investment statistics in Malaysia. Cradle on the other hand, serves as the interim secretariat for MBAN.

Angel Tax Incentive’s investment focus is in diverse areas of high growth technology industries with innovation including the following:

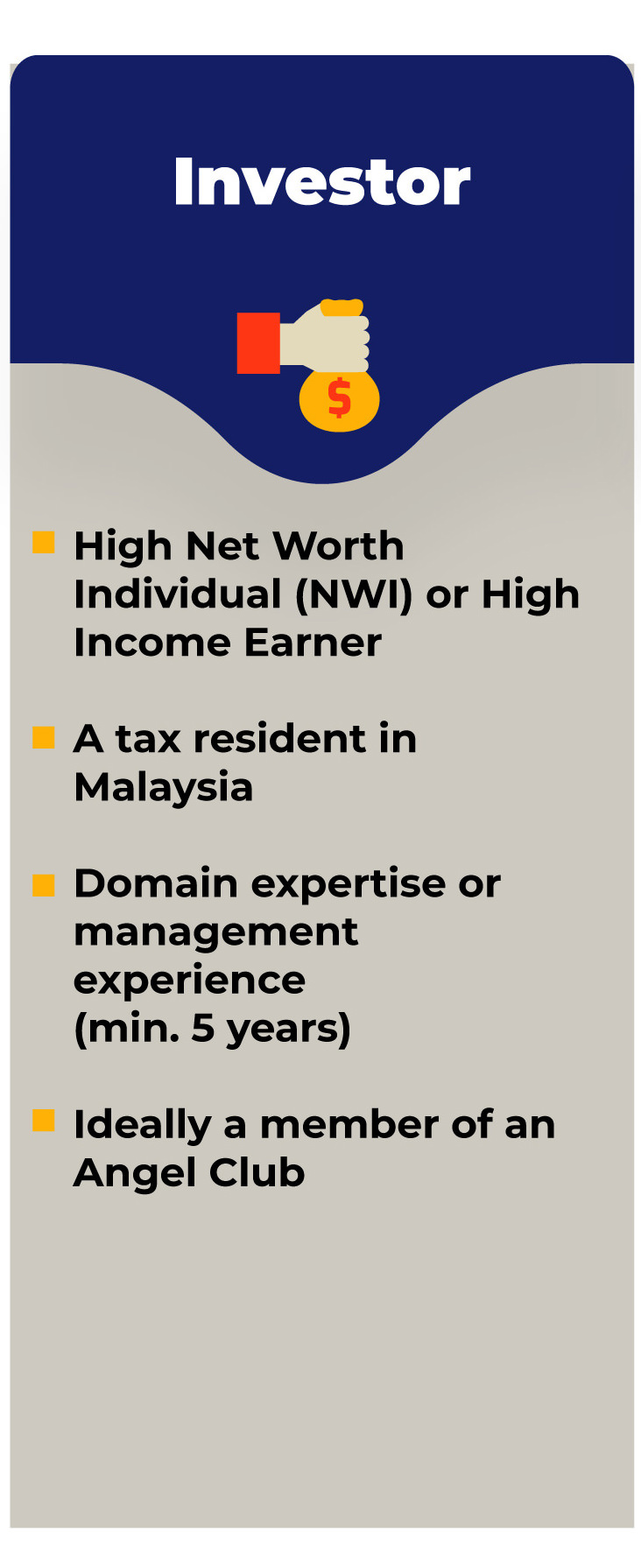

You must meet the following criteria to apply for accreditation:

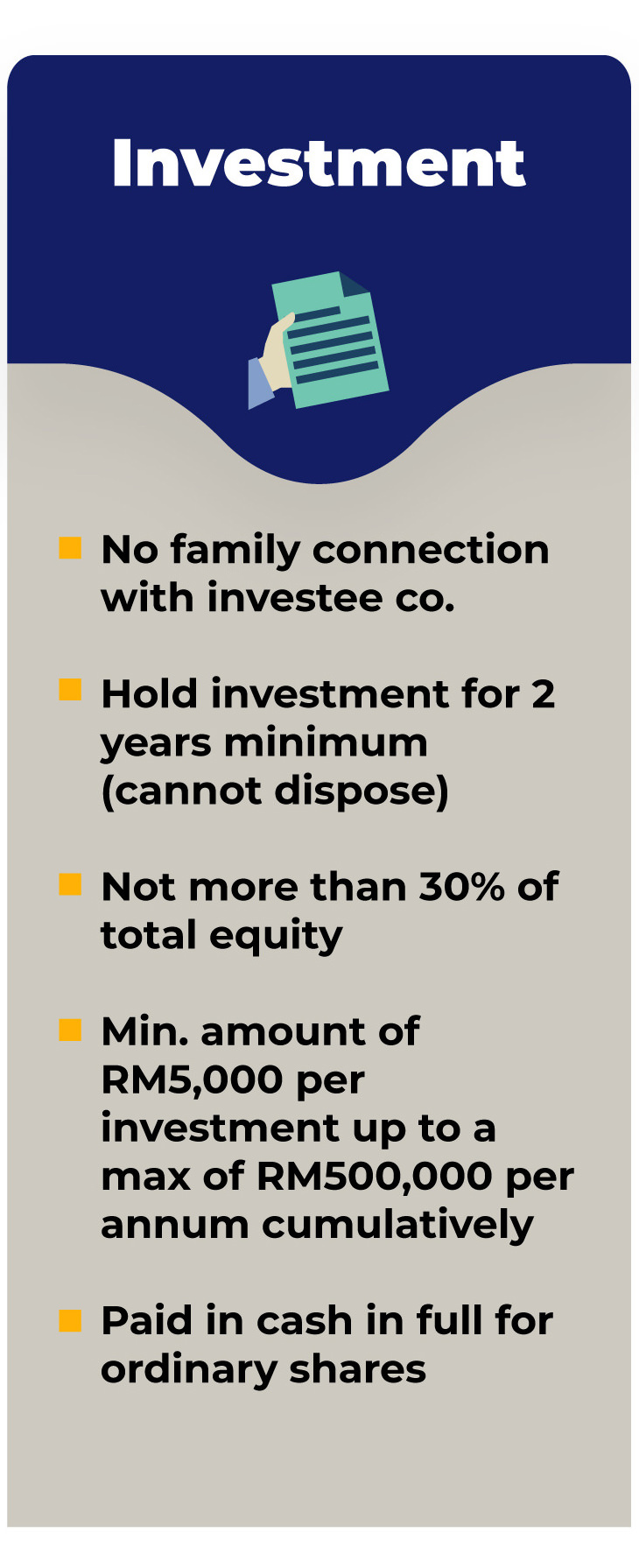

The investors must hold shares in the invested company for a period of two years prior to claiming the exemption. If the shares are disposed before the two years, the investment will be considered void for the tax incentive purposes. The investment is qualified for tax exemption on the third (3rd) year of his/her shareholding. For example, if an investment is made in the year 2013, the investor will be able to claim for tax exemption when he or she files for their tax returns in the year 2015.

The amount qualified for exemption is equivalent to the value of the investment made to the investee company. The aggregate income should comprise from all sources including business income for the basis period of year assessment.

You will need the following supporting documents to proceed with your application:

For High Income Earner:

For High Net Worth Individual:

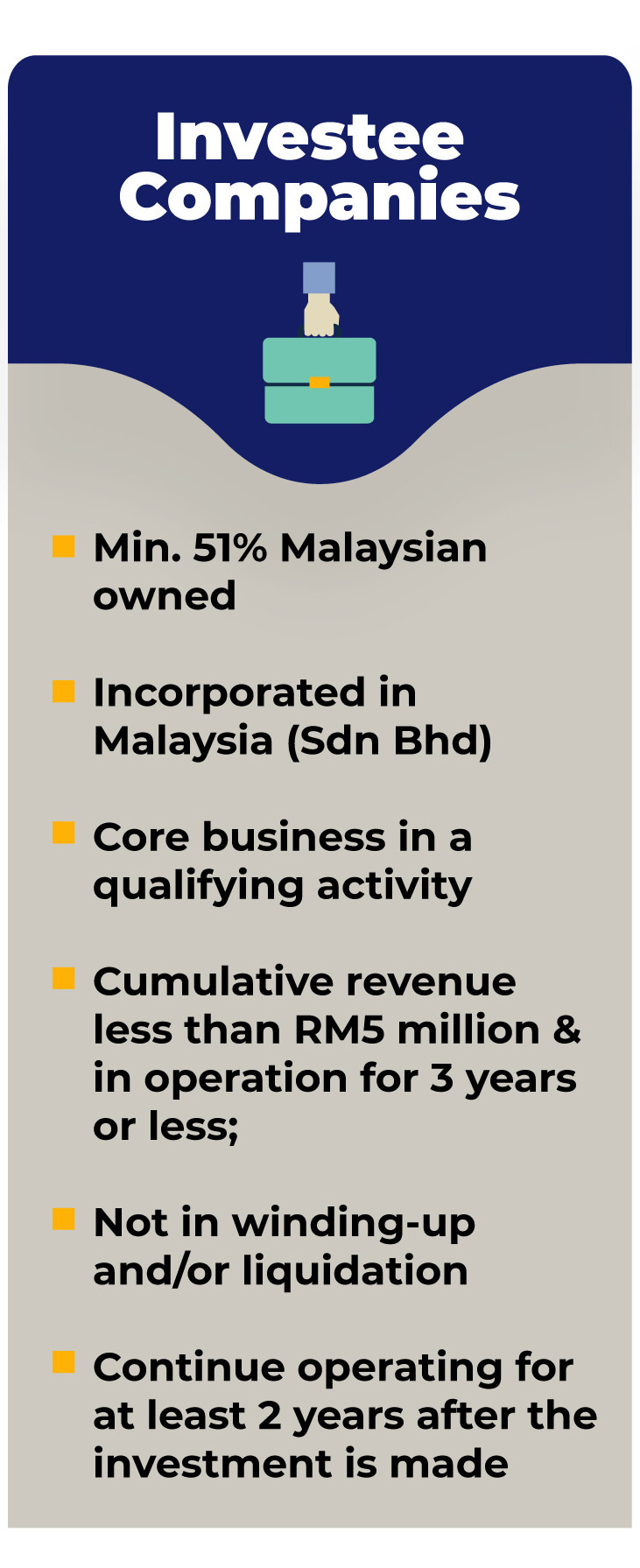

The investee company is obligated to notify Cradle of any changes of the company’s status which relates to the above criteria.

Angel Tax Incentive’s investment focus is in diverse areas of high growth technology industries with innovation including the following:

You will need the following supporting documents to proceed with your application: